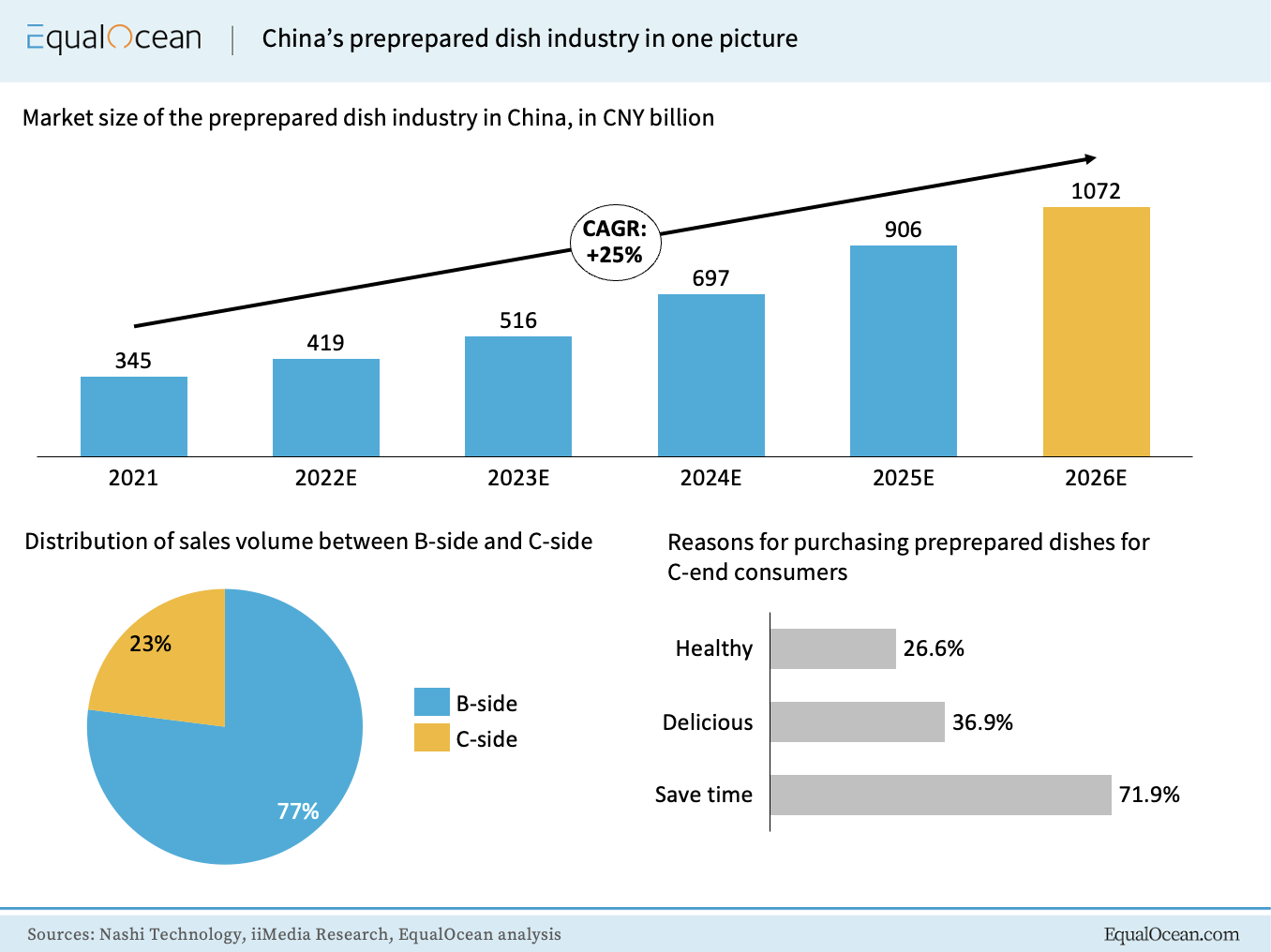

Nashi Technology (Chinese: 纳食科技) found that the current sales channels of preprepared dishes basically cover catering enterprises, supermarkets, convenience stores, e-commerce, community group purchasing and others. Among these, catering companies constitute the most important sales channels for preprepared dishes; the category is often described as a primarily B2B business type. This B2B business is also remaining dominant, with a sales volume of CNY 350 billion this year, compared to less than CNY 100 billion for the B2C market. However, the gap is expected to shrink as exposure and penetration continue to increase on the C-side. For instance, the sales volume of preprepared dishes witnessed exponential growth on major e-commerce platforms during the Chinese New Year holiday. Nashi Technology's chairman, Li Yan, noted that "eventually there will be no difference in consumption power between the B2B and B2C markets."

Moreover, competition in the prepared dish industry is fierce, with many local emerging brands such as Sanquan Food (Chinese: 三全食品) and traditional restaurant companies like Xibei (Chinese: 西贝) entering the market. In the short term, the industry pattern of fragmentation is expected to remain. Besides, investors continue to pour money into the industry. Funding peaked in 2015 and 2016, with 14 and 17 cases respectively. In 2020, there were a total of 23 financings in 2020 and 2021 for the preprepared dish track. As a result, there are many new entrants in the industry, all in the initial stage; the scale of each enterprise is small, and there are no leading enterprises that can guide the market's development. For instance, the market share of companies that laid out early in the preprepared dish market such as Anjoy Food (Chinese: 安井食品) is less than 2%.